Dissecting Bank Decision Criteria via Supervised 2-Satisfiability Reverse Analysis

DOI:

https://doi.org/10.37934/sijfam.7.1.3950Keywords:

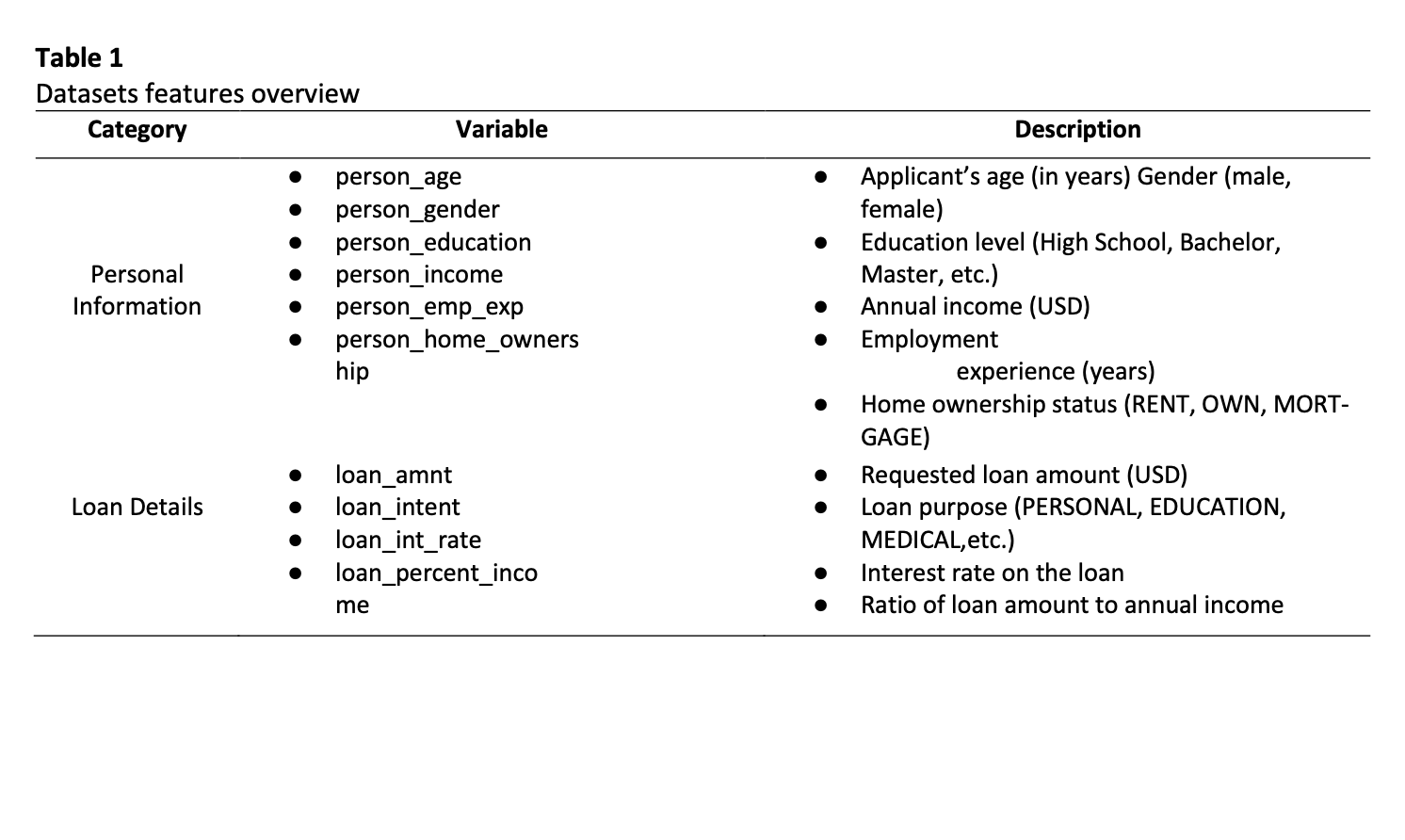

Bank loan approval, Supervised 2-Satisfiability Reverse Analysis, Hopfield Neural Network, correlation analysis, K-Means clustering, logical rule induction, performance metricsAbstract

Bank loan approval is a critical financial process that demands both accuracy and transparency to ensure fairness, regulatory compliance, and customer trust. However, many machine learning models act as “black boxes,” offering strong predictive power but limited interpretability, which restricts their adoption in banking. This study aims to develop an interpretable and transparent loan approval model using the Supervised 2-Satisfiability Reverse Analysis (S2SATRA) framework. The method integrates Hopfield Neural Networks with 2-Satisfiability logic clauses, enhanced by correlation-based feature selection and K-Means clustering for binary encoding. Model performance was evaluated on synthetic and real-world datasets using structured train-test splits and standard metrics, including accuracy, precision, recall (sensitivity), specificity, and F1 score. Results showed that the enhanced S2SATRA achieved up to 77.5% accuracy, 98.11% precision, and 78.62% recall, though specificity remained lower at 30.47%. These findings highlight the balance between interpretability and predictive capability, offering a logic-driven alternative to black-box models and supporting accountable decision-making in banking.