Non-Parametric Approach in Measuring Value-at-Risk using Historical Simulation Method

DOI:

https://doi.org/10.37934/sijfam.7.1.2338Keywords:

Value-at-risk, stock price, historical simulation, Geometric Brownian motion, Monte Carlo simulationAbstract

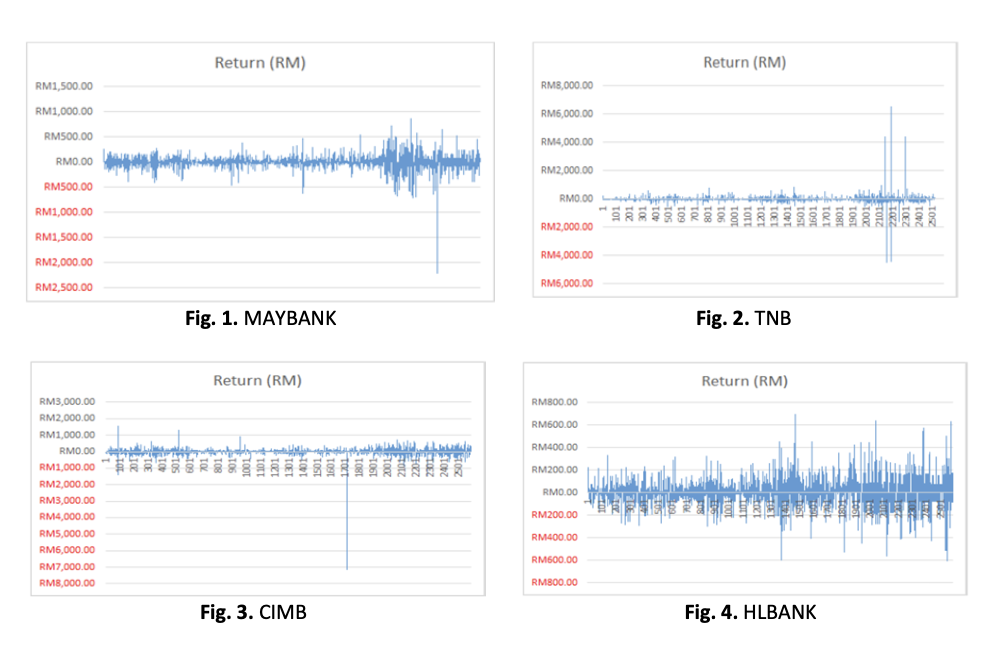

Risk assessment is fundamental to determine if an investment in stocks is worthwhile and what steps may be taken to alleviate risk. It determines what rate of return is necessary to make a particular investment in a stock succeed. One method to gauge the market risk is by calculating the Value-at-Risk (VaR) of the stock. VaR measures statistically, the potential loss amount of a risky asset or investment portfolio on the stock over a defined timeframe for a given confidence level. In this study, VaR of stocks for companies listed by the Kuala Lumpur Stock Exchange are being measured using the non-parametric approach which is the historical simulation method. Geometric Brownian Motion is then used to predict the stock prices for the first two weeks. The outcome shows that Malaysia Building Society Berhad is the riskiest as it gives the highest value at risk while Hong Leong Bank Berhad shows the lowest.