Analysis on Retirement Savings among Self-Employed in Malaysia: Comparison between Employees Provident Funds and Private Retirement Schemes

DOI:

https://doi.org/10.37934/sarob.6.1.5866Keywords:

Employee Provident Fund (EPF), Private Retirement Scheme (PRS), monthly retirement income, replacement ratioAbstract

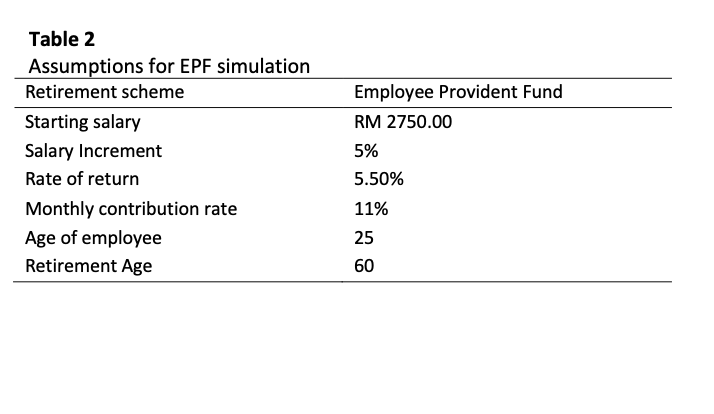

As at current, self-employed are not compulsory to contribute to any retirement savings funds. Therefore, this study examines the retirement saving options that are available for self-employed individuals in Malaysia, focusing on two major schemes, Employee Provident Fund (EPF) and Private Retirement Scheme (PRS). The paper highlights the importance of comprehensive retirement planning especially among the self-employed and policy enhancements to improve financial security towards Malaysian ageing population. By using deterministic modelling, the research simulates accumulated savings, projected retirement income, and replacement ratios for both schemes EPF and PRS under varying assumptions. The findings indicate that EPF offers the highest accumulated savings and monthly retirement income, outperforming PRS funds such as Public Mutual PRS Islamic. However, neither scheme achieves the recommended 70% replacement ratio or the poverty line income threshold of RM2,690 per month, underscoring the need for supplementary savings strategies. Limitations of deterministic modeling are acknowledged, and stochastic approaches are recommended for future research to account for variable economic conditions.