Analysing Determinants for Sustainability of Employees Provident Fund (EPF) during Retirement

DOI:

https://doi.org/10.37934/sarob.6.1.1229Keywords:

Employees Provident Fund, inflation rate, nominal gross domestic product, population aging, retirement, sustainabilityAbstract

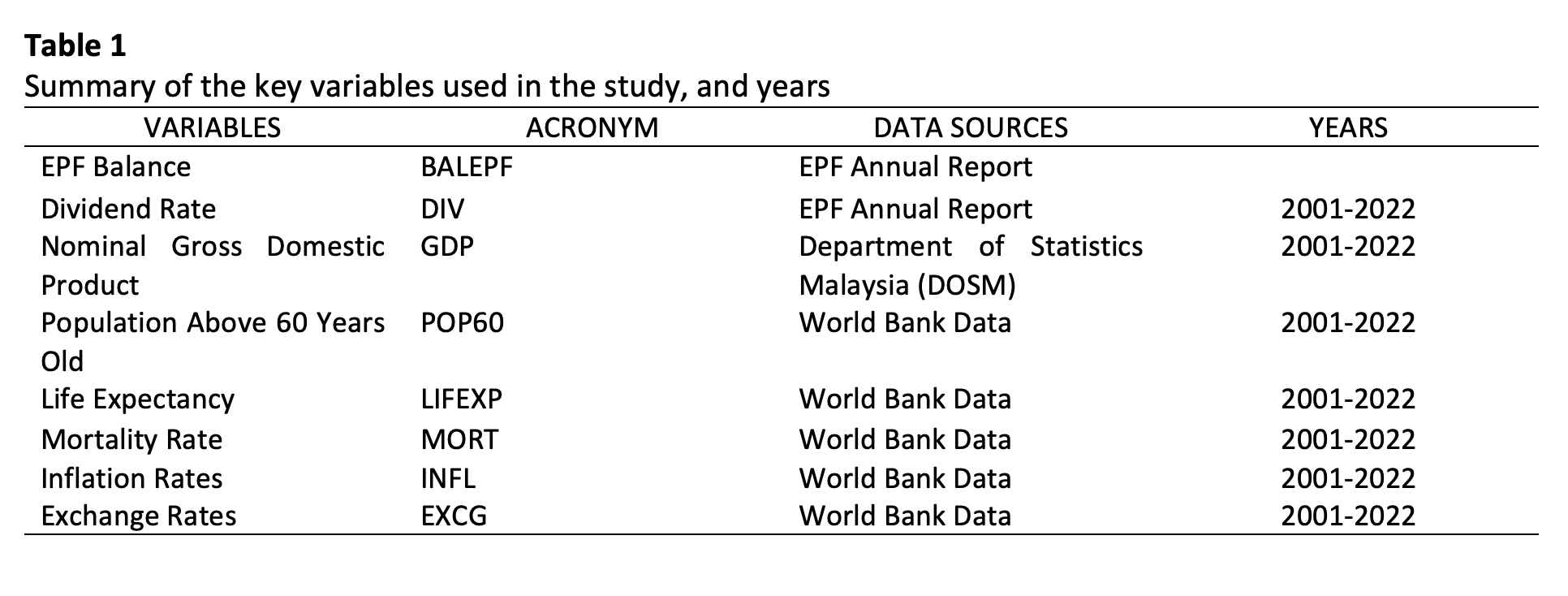

This study investigates the factors influencing the sustainability of the Employees Provident Fund (EPF) during retirement years in Malaysia, considering the demographic, economic, and health-related challenges faced by the aging population from year 2001 to 2022. The analysis evaluates interactions of seven key determinants: life expectancy, mortality rate, population above age 65, dividend rates, nominal gross domestic product (GDP), exchange rate, and inflation rates. Three significant predictors includes inflation rate, nominal gross domestic product (GDP), and the population above age 65were identified by using stepwise regression. The findings reveal that nominal gross domestic product (GDP) and population above age 65 have a positive and significant relationship with EPF sustainability indicating the critical role of economic growth and demographic aging in influencing retirement savings. Conversely, the inflation rate exhibits a negative and significant relationship with the EPF sustainability highlighting the adverse impact of inflation on the long-term viability of retirement funds. These results provide valuable insights for policymakers, emphasizing the need to mitigate inflationary pressures while promoting economic growth and addressing demographic challenges to ensure the strength of Malaysia's retirement system.