Factors Influencing Crude Oil Prices in Malaysia: A Time Series Analysis

DOI:

https://doi.org/10.37934/sijmaf.5.1.2233Keywords:

Crude oil prices, GDP, interest rate, inflation rate, exchange rate, multiple linear regression, time series analysisAbstract

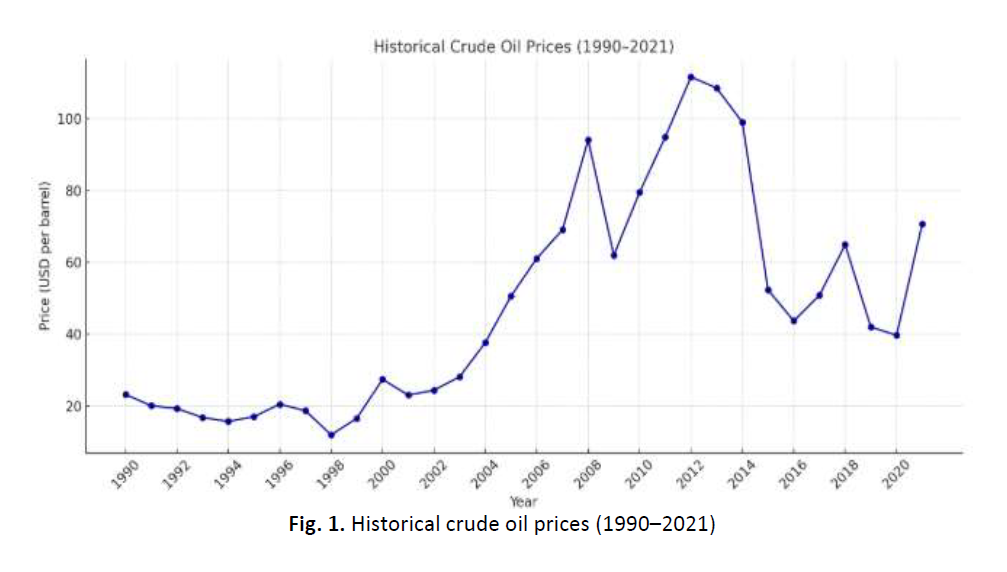

This study investigates the factors influencing crude oil prices in Malaysia by analyzing the impact of key economic variables, including GDP, interest rate, inflation rate, and real exchange rate. This study uses time series analysis to investigate these links using historical data from 1990 to 2021. The findings demonstrate the crucial role that economic growth plays in generating energy demand by showing that GDP has a considerable and beneficial impact on crude oil prices. Conversely, the inflation rate, interest rate, and real exchange rate show weaker or statistically insignificant relationships, indicating limited direct impacts on crude oil prices during the study period. Furthermore, the stationarity of variables at the first difference ensures the suitability of the data for advanced time series modeling. The results present insights for stakeholders and policymakers and highlight the significance of GDP as a major factor influencing the dynamics of crude oil prices.