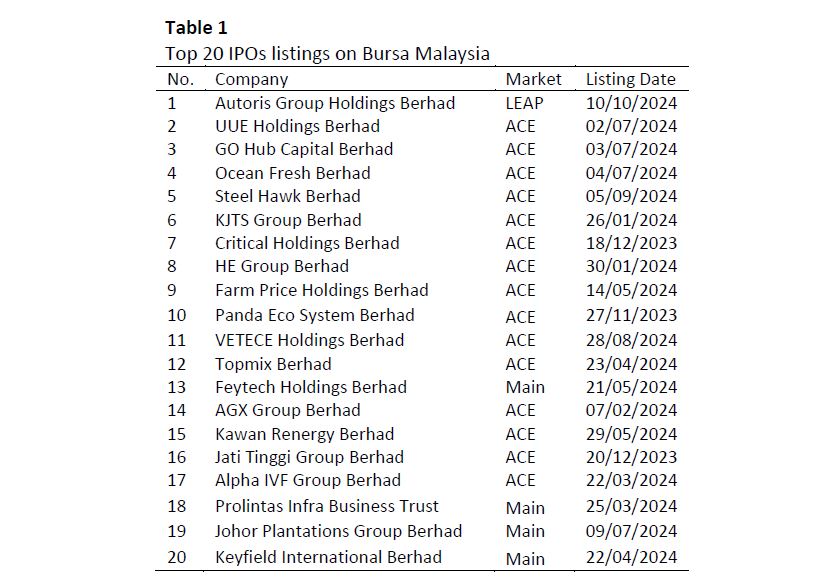

A Review of Top 20 Performance of Initial Public Offer Malaysia 2024

DOI:

https://doi.org/10.37934/sijmaf.4.1.1826Keywords:

Initial Public Offerings (IPOs), bursa malaysia, post-listing performance, market capitalization, percentage gain, investment analysis, financial marketsAbstract

Initial Public Offerings (IPOs) are critical mechanisms for companies seeking to raise capital and expand their operations. The increasing frequency of IPO listings on Bursa Malaysia highlights the need to assess their post-listing performance. However, many investors struggle to understand the factors that influence the success or failure of these offerings, leading to significant variability in investment returns. This study aims to evaluate the post-listing performance of the top 20 IPOs on Bursa Malaysia as of October 24, 2024, by analysing key metrics such as percentage gains or losses in share prices and market capitalization. The research employs a systematic approach, utilizing data collected from Bursa Malaysia's official records and reports. The study calculates the percentage gain or loss for each IPO by comparing the initial listing price with the current market price. Additionally, the IPOs are categorized based on their market segment (ACE Market or Main Market) and ranked according to their performance. The principal results indicate notable differences in performance among the top 20 IPOs, with specific trends emerging related to market categorization and investor sentiment. The findings suggest that certain sectors and market conditions significantly influence the success of IPOs, providing valuable insights for investors and companies considering future listings. In conclusion, this research contributes to the understanding of IPO performance in Malaysia and highlights the importance of thorough analysis for maximizing investment returns. The results are intended to inform stakeholders, including investors and policymakers, about the dynamics of IPO success in the Malaysian context.