Adaptive Portfolio Strategies: Comparing Pre-, during and Post-COVID-19 Dynamics using Mean-Variance Optimization

DOI:

https://doi.org/10.37934/sijmaf.4.1.117Keywords:

Financial market, mean variance optimization, Covid-19, sharpe ratio, risk returnAbstract

This study examines the influence of the COVID-19 epidemic on the global stock market using mean-variance optimization (MVO) based on Markowitz's portfolio theory. The analysis examines the performance of portfolios tailored to different sectors both before, during and the post-pandemic. It provides insights into the changes in risk-return characteristics across diverse businesses. The dataset consists of the mean closing prices of a variety of stocks, divided into two/three separate periods: before the outbreak of COVID-19, during the COVID-19 and post-pandemic. The study utilizes covariance matrices, anticipated returns, and logarithmic returns to calculate efficient frontiers that emphasize portfolios with the highest Sharpe ratios. The results demonstrate substantial alterations in the relationship between risk and return in several industries, illustrating the diverse influence of the pandemic on the

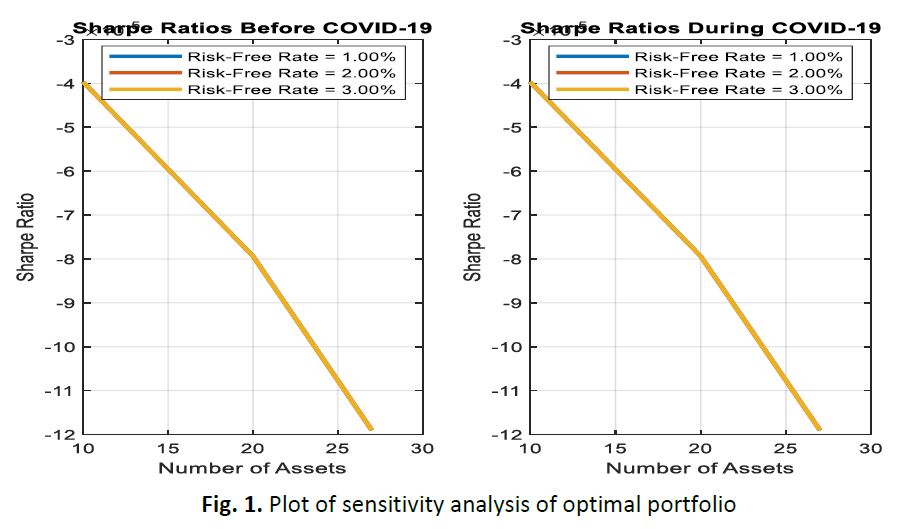

market. The efficient boundaries clearly illustrate a significant change in the optimal weights and risk levels of portfolios, with certain sectors experiencing higher volatility and lower returns amid the epidemic. The study also does a back testing of the optimal portfolios, uncovering varying levels of performance and durability during the periods. These findings underscore the importance of implementing adaptive portfolio management strategies, particularly in the face of global crises such as COVID-19. In addition, the study performs a sensitivity analysis by altering important criteria such as the risk-free rate and the quantity of assets in the portfolios in order to assess the strength and reliability of the results. This research provides a more profound understanding of how changes in assumptions can impact portfolio performance and the selection of optimal choices. In summary, this research provides significant information for investors by offering a quantitative framework that can help in effectively managing portfolios during periods of market volatility. The study emphasizes the importance of employing adaptable investing strategies to minimize risks and maximize returns in the face of unprecedented problems such as the COVID-19 pandemic.