Empowering Financial Literacy and Sustainability among UMT Undergraduate Students

Keywords:

Financial literacy, undergraduates, young adults, financial knowledge, financial sustainabilityAbstract

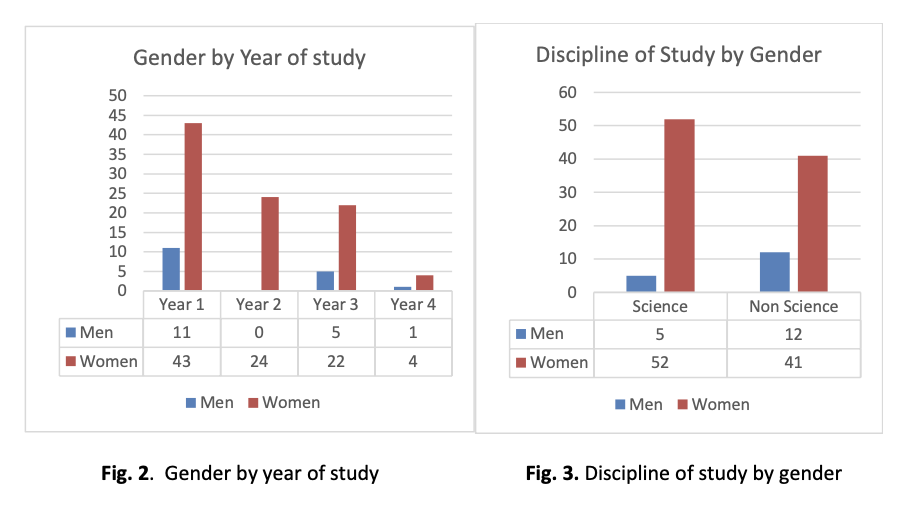

Financial literacy is crucial for undergraduate students as they transition into adulthood and begin managing their financial decisions independently, without parental supervision. According to the Institution Research & Development of Policy (IRDP), between 2018 and 2022, approximately 10,378 Malaysian youths declared bankruptcy, with over 20 percent of them being under the age of 34. This significant statistic highlights the challenges in managing debts and financial commitments in adult life. Undergraduate students will soon face similar financial decision-making challenges, including budgeting, saving, and debt management. Additionally, sustainable financial planning is becoming increasingly important as understanding the long-term impact of financial decisions on personal well-being and financial stability is essential. This research investigates the financial literacy and awareness of financial sustainability among undergraduate students at the University of Malaysia Terengganu (UMT). The research sample consists of 110 UMT students from various academic disciplines and years of enrollment, including both those with and without a financial background from their study programs or activities. The data will be analyzed using Social Sciences Software (SPSS) for descriptive, correlational, and multiple regression analyses. The results show a positive correlation among the variables, with multiple regression demonstrating a strong relationship between sustainable financial literacy and UMT undergraduates. The findings also suggest that universities can play a pivotal role in equipping young adults with the knowledge and experience necessary to enhance their financial sustainability literacy for the future.