From Pension Gaps to E-Wallets: The Role of Fintech in Supporting Malaysian Senior Citizens’ Gig Economy Participation

Keywords:

Fintech, senior citizen, e-walletAbstract

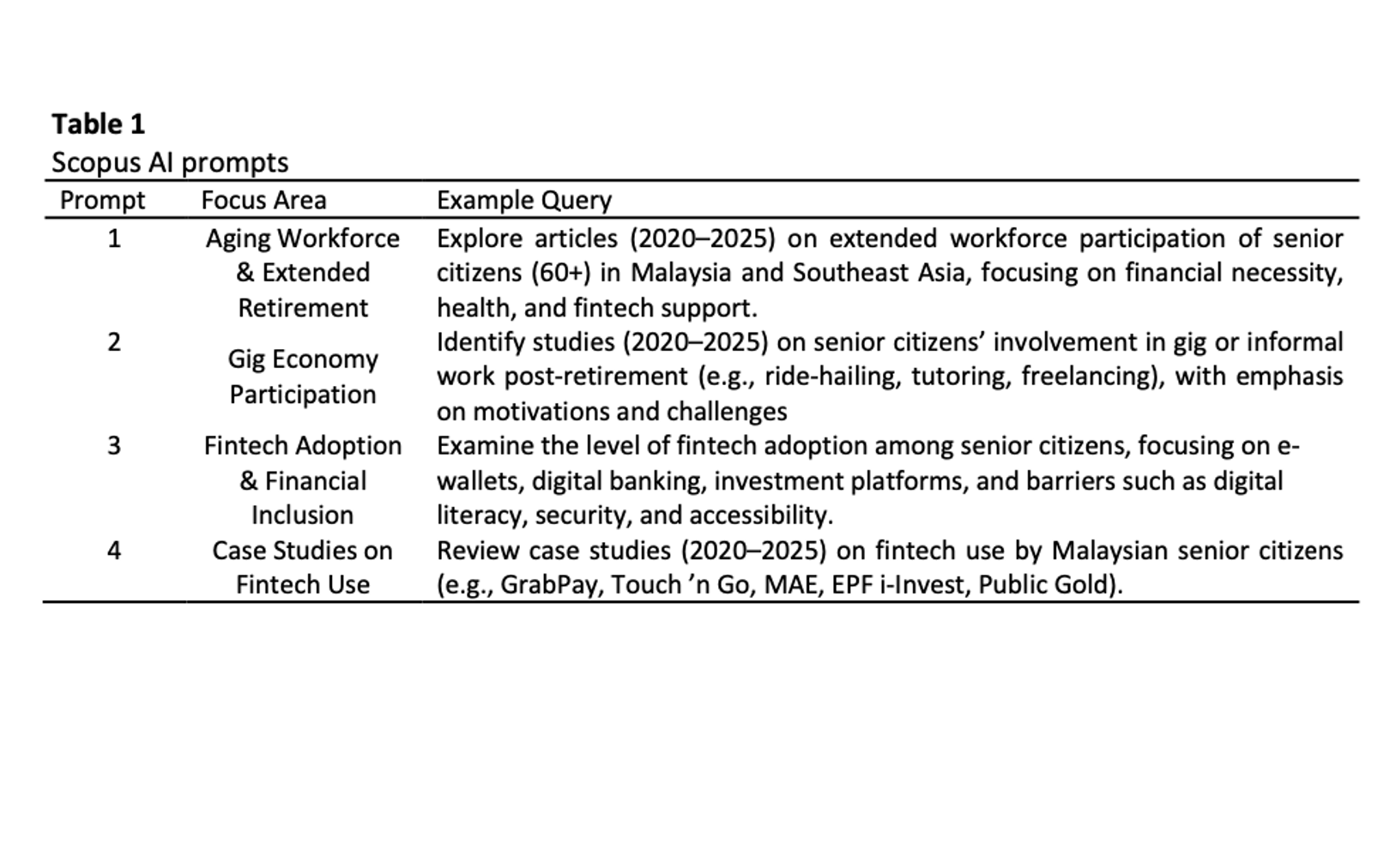

Malaysia’s ageing population faces widening pension gaps, compelling many senior citizens to remain economically active through side hustles and gig economy work. While flexible work provides supplementary income, it also exposes seniors to financial insecurity and irregular earnings. Financial technology (Fintech), particularly e-wallets and digital savings tools, has emerged as a potential enabler of financial resilience. This study employs a systematic literature review (2020–2025) using Scopus AI to explore the intersection of pension adequacy, gig participation, and fintech adoption among Malaysian senior citizens. Findings highlight that financial necessity, improved health, and human capital drive continued workforce participation, while limited financial literacy and digital skills hinder fintech uptake. E-wallets and digital investment platforms offer seniors greater control over money management, but inclusive design, tailored digital literacy initiatives, and policy support are essential to close adoption gaps. The paper contributes to understanding how fintech can bridge pension shortfalls and strengthen financial inclusion in Malaysia’s ageing society.