Harnessing Sustainable Skills for TVET Students in Entrepreneurship and Islamic Finance: A PRISMA Review

DOI:

https://doi.org/10.37934/sijeebd.4.1.4960Keywords:

Islamic finance, sustainable entrepreneurship, TVET, systematic review, PRISMAAbstract

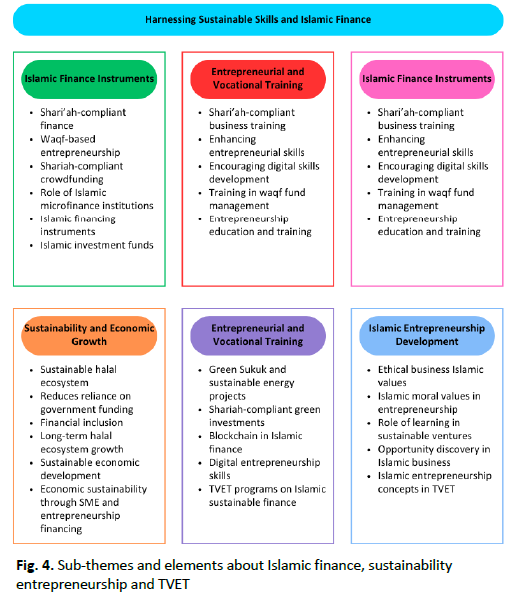

Sustainable entrepreneurship is the answer to tackling global challenges like unemployment, social inequality, and environmental degradation. Islamic finance, an alternative financial model, provides a framework for economic entrepreneurship with ethical and inclusive financial principles. Nevertheless, limited research has been conducted within the realm of Islamic finance about TVET, specifically from a student perspective. Using a PRISMA-based methodology, this study fills current literature gaps by systematically reviewing 47 peer-reviewed articles published between 2020 and 2025 and providing the students' concerning embedding Islamic finance. Results show that Sukuk, Zakat, and Waqf are viewed as viable, value-coherent sources of financing for students and have a profound stimulating impact on their interest and preparedness for entrepreneurial enterprise. Moreover, the inclusion of Islamic finance principles into TVET curricula would further promote financial literacy, ethical business practices, and sustainability-driven entrepreneurial mindsets among students. However, from the students' perspective, regulatory constraints, limited awareness of Islamic finance opportunities, and insufficient curricular content on Islamic entrepreneurship are still considered major barriers. Further, collaborative efforts between policymakers, educational institutions, and financial institutions to address these challenges can significantly improve students' engagement and support for Sharia-compliant financing initiatives for sustainable ventures. Future research should include empirical studies reflecting a student's lived experience and pilot educational programs to validate these findings effectively.