Customers’ Perceptions, Trust, and Financial Literacy: A Re-Examination of Medical Insurance Purchase Decision Amidst Price Restructuring

Keywords:

Medical insurance purchase decision, perceived risk, perceived product benefit, perceived private healthcare quality, trust, financial literacyAbstract

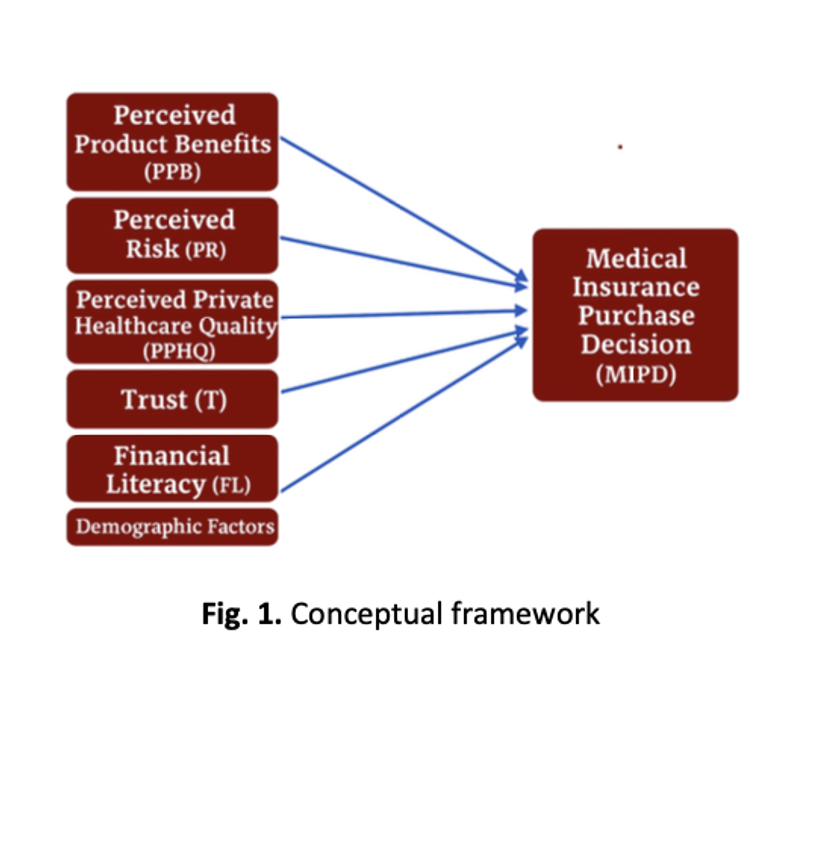

Malaysia’s insurance industry remains the vital backbone and a safeguard for many sectors, particularly healthcare. Medical insurance provides financial protection against the consequences of health risks. Due to medical cost inflation, a premium price hike is necessary to keep up with the rising cost. This study looks at the internal factors, particularly on the policyholders’ part, that may affect the decision to purchase medical insurance. Data is collected through a questionnaire distributed to Malaysian adults. Using data collected from 404 respondents, the Multiple Linear Regression analysis is performed to analyze and examine the relationships between the five independent variables and medical insurance purchase decisions. The results show that all independent variables have a significant effect on the medical insurance purchase decision. In addition, age groups, marital status, as well as education level are found to have significant impact on the medical insurance purchase decision. This study provides some valuable insights, especially to insurance providers, on factors they should tackle, as well as implement unique strategies for different demographic profiles to support the purchase decision of medical insurance despite the unavoidable premium price hike.