Chinese Fintech Goes Global: Institutional Models, Market Realities, and Strategic Lessons

DOI:

https://doi.org/10.37934/sijmaf.5.1.3442Keywords:

Chinese fintech internationalization, Alipay, WeChat Pay, regulatory compliance, digital payment ecosystems, cross-border mobile paymentsAbstract

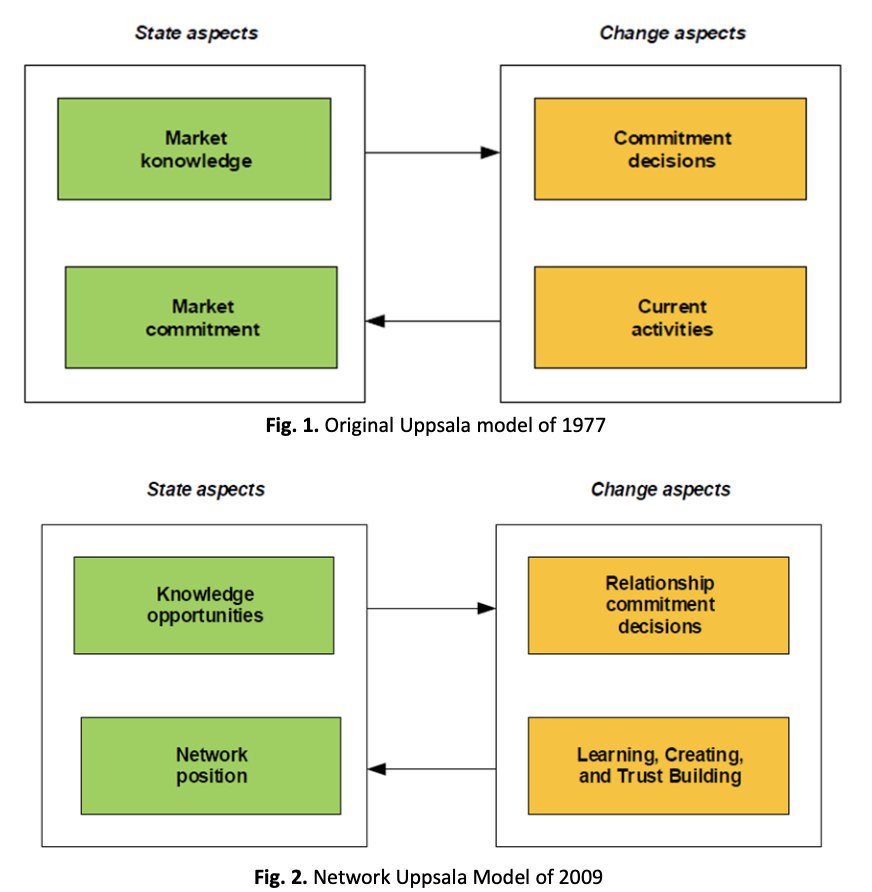

Over the past two decades, Chinese fintech platforms Alipay and WeChat Pay have emerged as global leaders in digital financial services and expanding into global markets. This paper explores the internationalization strategies of these firms through the Uppsala Internationalization Model and Product Life Cycle Theory. This study also examines how these models adapt in the digital context. The study highlights how fast growth, government diplomacy, and technology networks enabled these platforms to enter diverse international markets. Even though these firms have advanced technology, they face multiple challenges in international expansion. These include regulatory challenge, geopolitical scrutiny, and technological mismatches between QR-code-based and Near Field Communication (NFC)-based systems. Case studies of Thailand, Indonesia, and Western countries illustrate different degrees of success and regulatory compliance. Moreover, the paper discusses how trust, security, and integration into local digital ecosystems significantly influence user adoption. This paper also provided strategic recommendations include co-designing regulations with local authorities, adopting hybrid payment systems, and ensuring culturally adapted user experiences.